Have You Outgrown Your Home?

It may seem hard to imagine that the home you’re in today – whether it’s your starter home or just one you’ve fallen in love with along the way – might not be your forever home.

The good news is, it’s okay to admit if your house no longer fits your needs.

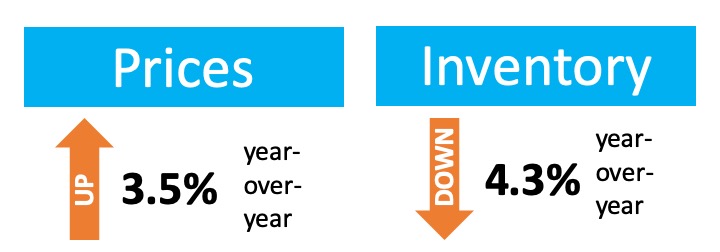

According to the latest Home Price Insights from CoreLogic, prices have appreciated 3.5% year-over-year. At the same time, the National Association of Realtors (NAR) reports inventory has dropped 4.3% from one year ago. These two statistics are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

These two statistics are directly related to one another. As inventory has decreased and demand has increased, prices have been driven up.

This is great news if you own a home and are thinking about selling. The equity in your house has…

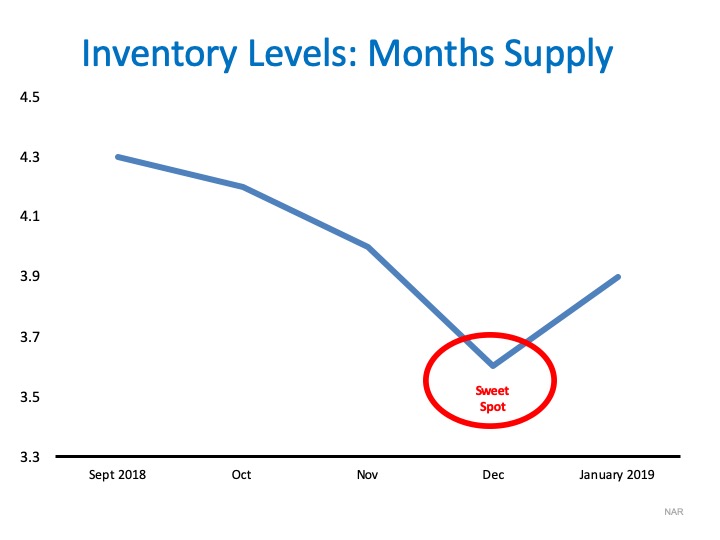

As you can see, the ‘sweet spot’ to list your house for the most exposure naturally occurs in the late fall and winter months (November – January). …

As you can see, the ‘sweet spot’ to list your house for the most exposure naturally occurs in the late fall and winter months (November – January). …

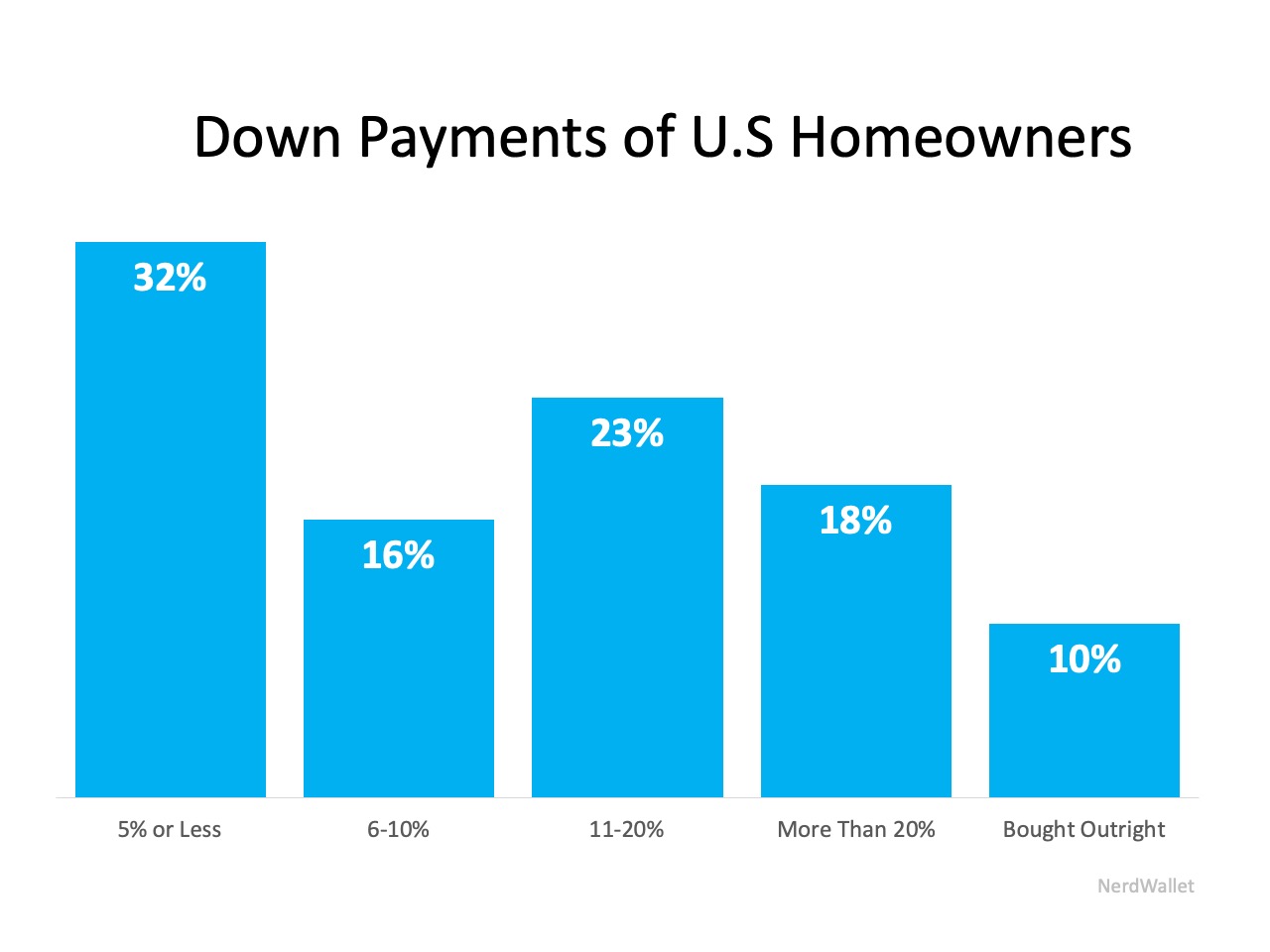

The lack of knowledge about the…

The lack of knowledge about the…

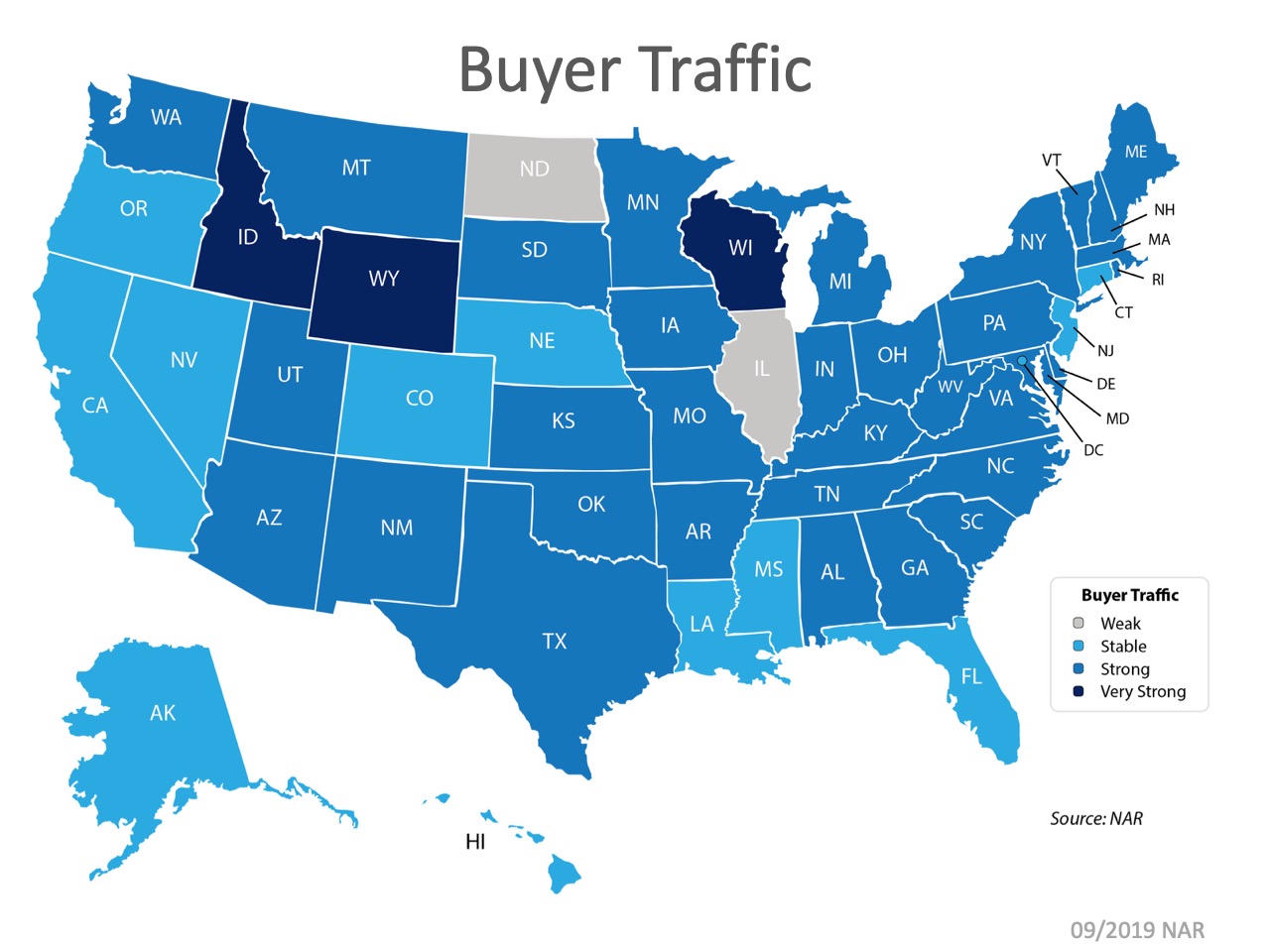

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong;…

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong;…